When a big section of a country’s population is smartphone savvy rather than being reliant on desktop computers, the country becomes ‘super app’ ready.

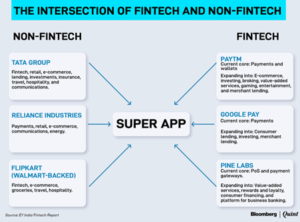

Indian super apps are gaining traction. Given the increasing interest among India’s largest business houses in delivering a Super App platform, it is rightly named ‘The Land of Rising Super Apps’. In many respects, the super app has become the Holy Grail that every company wants to own, from conglomerates like Tata and Reliance to fintech players like Paytm and even Big Tech firms like Facebook and Amazon.

But Is India ready for a China-like super app influx? Let’s find out.

What Makes A Super App A Success In India?

A super app is a platform created by a company that offers a variety of services under one roof. Companies that have a myriad of services and goods to offer typically combine their offers into a super app.

The crediting option will be the fourth addition to Truecaller in the previous two years. So far, it has introduced the ability to text, record phone calls, and mobile payment services; some of which are only available to customers in India. Truecaller has 140 million daily active users, 100 million of whom are Indian. Truecaller’s story exemplifies an intriguing stage in India’s internet economy, in which a number of companies are transforming their single-functioning apps into multi-functioning super apps.

A successful Indian super app will be more than a platform-based business model. It will first require a killer habit for high-frequency, frictionless usage. Consider Whatsapp or Paytm. Furthermore, it will need to forge and integrate multiple sub-ecosystems in order to assure zero broken customer journeys throughout a united ecosystem. Consider Jio’s recent foray into bundling OTT streaming platforms.

Key Players & Their Strengths

The key players can be divided into two categories:

1) Financial Super Apps

Financial services are being re-bundled as fintech businesses expand their offerings beyond key areas. Among the key factors influencing re-bundling are:

-Access to necessary infrastructure

-Chance to monetize data and the user base by cross-selling other financial products and services.

A payment app that becomes a customer’s initial “digital” point of contact can subsequently sell multiple financial products through the same digital distribution channel. Here are a few notable examples:

a)PayTM

b)Phone Pessimistic

c)Yono SBI

d)Bajaj Finance Ltd.

2) Non-Financial Apps

Banks and even non-banks compete with financial technology startups moving toward super apps. The majority of global super apps have originated from non-financial services firms. Consumer tech and e-commerce enterprises incorporate diverse financial product and service offerings to create a super app. Following are some examples:

a) Tata Neu

b) Reliance

c) Flipkart

d) Amazon India

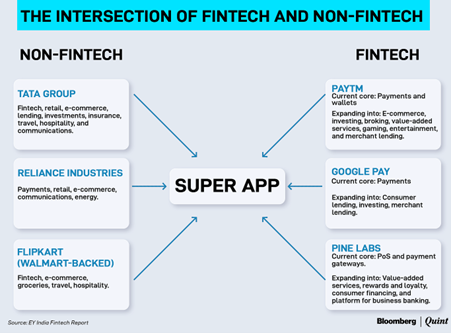

Smartphones as Growth Drivers

According to a survey produced jointly by the Indian Cellular and Electronics Association and consultancy company KPMG, India’s smartphone population is expected to surpass 820 million this year. Experts believe that the country’s adoption of super apps will skyrocket as a result of this tremendous increase.

Because smartphones have limited storage and memory, super apps are best suited to mobile-first markets such as India. This is because they demand less storage and memory than various apps for different uses.

The use of mobile banking is rapidly increasing. The number of mobile and internet transactions is currently neck and neck. Companies are aware of this and, as a result, are betting on the fastest-growing smartphone user base in the country.

In Context Of A Booming Economy

The opportunities for super apps are being thrown open by India’s booming consumer digital economy. It is expected to grow from $90 billion in 2020 to $800 billion by 2030, with internet retail accounting for a sizable portion.

Over the next decade, India’s online retail market is expected to rise to $350 billion in gross merchandise value (GMV) from $55 billion this year ( the amount of items sold on a platform excluding discounts and returns).

No consumer goods company can afford to pass up this opportunity.

Bundling & Unbundling

Netflix is a successful example of unbundling (of traditional TV) and re-bundling (through streaming), all while developing a superior product experience and organising the consumers’ entertainment world for them. Jio has taken it a step further as an aggregator, combining many OTTs into one.

The India super app opportunity has massive bundling, unbundling, and re-bundling models to navigate before facing the challenge of better organizing consumers’ worlds. The winning super app will better organise the consumer’s world, just like Google did for the world’s information.

The Future

According to the World Economic Forum, digital-led platform business models will generate 70% of new economic value. As super apps become more popular in India, addressing regulatory concerns about data protection and developing a strong infrastructure would be critical. With the passage of time, new obstacles will emerge. The regulation must be amended to reflect this. Issues such as cryptocurrency, data privacy legislation, and so on must be addressed in the proper manner.

‘Collaborate or die,’ is the credo that the super apps of the future will follow. Experts also warn that smaller and specialist businesses that struggle to secure suitable partnerships and are unable to generate sufficient critical mass, may struggle to survive. Today, everyone understands that the game is not meant to be played alone. It is also not simply about forming new alliances. The success motto is to form long-term, sustainable business ties.

Get in touch with us to learn how you can create more valuable connections with customers on Indian super apps.